Digital-first banking is on the rise, and financial institutions are evolving their customer engagement approaches. Customers today expect instant, personalized responses at any time of day, and traditional systems/methods simply cannot keep up — but the use of Generative AI in banking is changing that!

Generative AI is not just automating workflows. It is enabling banks to deliver human-like, intelligent interactions that are fast, accurate, and personalized at scale!

What Is Generative AI in Banking?

Conversational AI assistants

- Personalized recommendations for financial products

- Automated customer service

- Natural language queries for account level information

- Smart document generation (e.g., summaries on loans, financial reports )

When banks leverage AI powered customer service, they can move beyond static chatbots to conversational as a customer experience. Naturalistic and helpful.

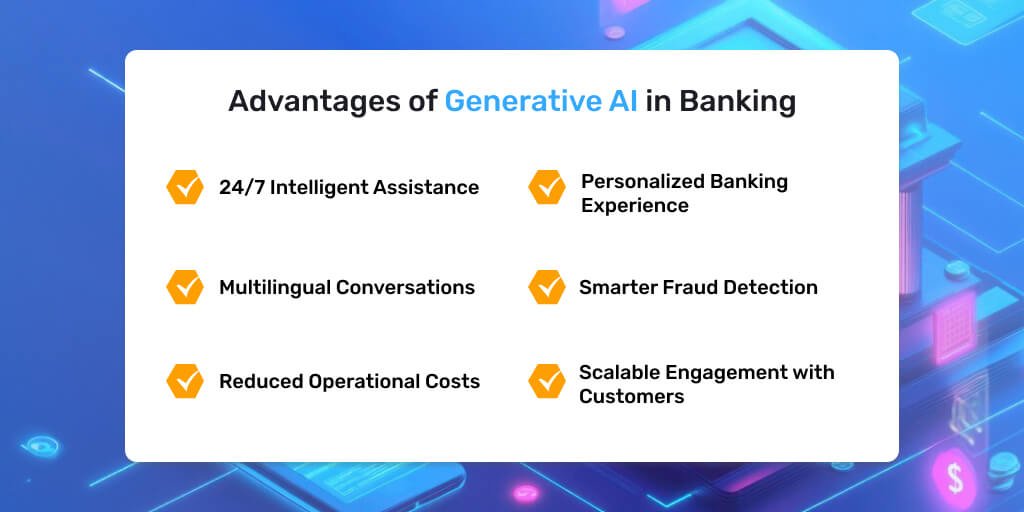

6 Important Advantages of Generative AI in Banking

24/7 Intelligent Assistance with Generative AI in Banking

Consumers can reach out to an AI agent anytime to resolve an issue, check balances, or apply for a product.

2. Personalized Banking Experience

AI looks at the consumer’s transaction history and preferences to provide tailored financial advice.

3. Multilingual Conversations

Serve constituents across India and around the world in their preferred language, increasing inclusion.

4. Smarter Fraud Detection

AI is able to recognize suspicious behavior happening during chats and can flag fraudulent activity in real time.

5. Reduced Operational Costs

AI minimizes the need for large teams of support staff, resulting in savings on hiring support teams and any associated infrastructure.

6. Scalable Engagement with Customers

Banks can engage with millions of customers in their apps, WhatsApp, websites, IVR systems.

Challenges in Implementing Generative AI in Banking

There are important obstacles to implementing generative AI, even with its potential value:

Data Privacy and Security

Must follow the framework of GDPR, RBI Guidelines and ISO 27001.

Training and Accuracy

Must train generative AI on domain-specific data to ensure it provides correct and compliant responses.

Integration of Legacy Systems

The banks operate on old systems that may run on mainframes and lack the APIs necessary to connect with generative AI.

Bias and Ethics

Generative AI must rely on the model and datasets to avoid bias; unless the model is checked, assumptions cannot be made.

Use Cases of Generative AI in Banking

Voice AI to support IVR systems – Bots that can interface with phone banking via voice.

Smart Customer Relationship Management – Personalized customer journeys/progressions.

AI-powered Know Your Customer (KYC) / Onboarding – Verification of documents and other items for onboarding customers more quickly.

Loan or Investment Advisory – Provide recommendations (real or personalized AI-generated recommendations).

How Hutech Solutions Helps Banks Leverage Generative AI

At Hutech Solutions, we specialize in full-cycle AI/ML implementation for BFSI clients. Here’s how we help:

Consultation & Use Case Discovery

Identifying impactful areas like customer service, onboarding, fraud detection.

Custom AI Model Development

Built on OpenAI, Azure OpenAI, or Google Vertex — customized for banking.

Seamless Integration

We connect AI with CRMs, APIs, core banking for unified operations.

Compliance & Security

Implementations aligned with RBI, GDPR, ISO standards.

Multichannel Deployment

Deploy on mobile apps, websites, IVRs, WhatsApp, and more.

Training & Support

We enable your teams and offer continuous support post-deployment.

Want to implement Generative AI in your bank?

Partner with Hutech Solutions to build secure, scalable, and intelligent banking experiences.

Conclusion

Generative AI in banking is going from an option – to a necessity for growth. The benefits are clear, from improved satisfaction to lowering operational overhead, there is no denying that the pros are in favor of incorporating it into banking.

By partnering with Hutech Solutions for your AI implementations, you can feel confident in your transition to generative AI and be able to focus on your next-generation customer experience.

Frequently Asked Questions

Yes — encryption, access controls, and regulatory compliance ensure safety and reliable.

No. It complements human agents, handling routine queries and helping them work with higher efficiencies.

Generally 4-12 weeks, depending on the complexity.

Yes – with modular AI solutions and cloud deployments, all banks including regional banks can afford it.

Ready to Advance your Digital Transformation?Get in touch with us.

Discover why Hutech is the right partner for your business.

MAIL US AT

sales@hutechsolutions.com

CONTACT NUMBER

+91 90351 80487

CHAT VIA WHATSAPP

+91 90351 80487

ADDRESS:

Humantech Solutions India Pvt. Ltd

163, 1st Floor, 9th Main Rd,

Sector 6, HSR Layout, Bengaluru,

Karnataka 560102