The banking industry is undergoing a major transformation as customer expectations evolve dramatically. Today’s customers demand instant transactions, personalized experiences, and seamless digital banking—none of which can be delivered effectively using outdated legacy core banking systems. Yet, many co-operative banks continue to rely on legacy infrastructure, creating a widening technology gap that threatens their competitiveness, customer satisfaction, and long-term success.

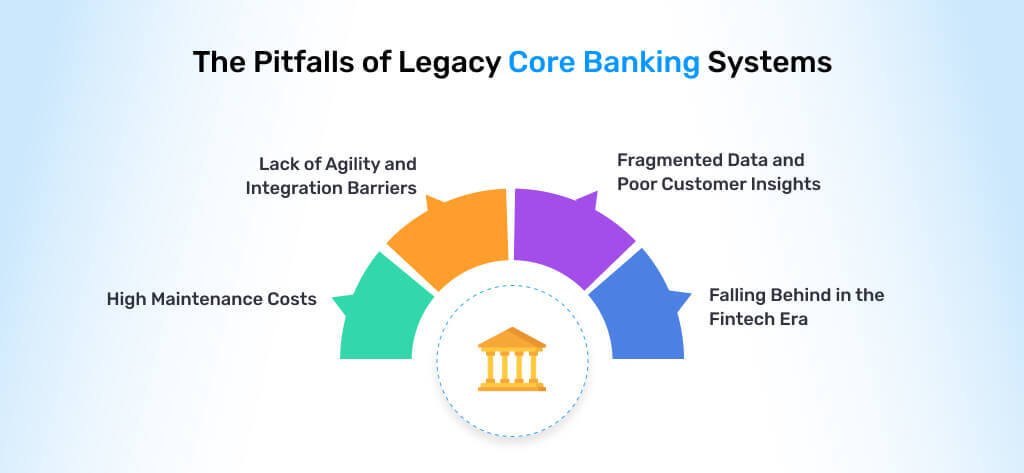

The Pitfalls of Legacy Core Banking Systems

Lack of Agility and Integration Barriers: Legacy systems are rigid and difficult to adapt. They cannot easily integrate with modern banking technologies such as mobile apps, cloud infrastructure, and open APIs. This lack of flexibility slows down digital transformation, while fintech startups and neobanks leverage modern stacks to deliver superior, faster, and more personalized services. This places co-operative banks at a significant competitive disadvantage.

Fragmented Data and Poor Customer Insights: Old core banking systems operate in silos, storing data in fragmented formats. This prevents banks from gaining a 360-degree view of customer data, which is essential for delivering personalized banking services. Without integrated data, co-operative banks struggle with targeted marketing, customized offers, and data-driven decision-making.

High Maintenance Costs: Legacy systems consume a significant portion of IT budgets. Co-operative banks often spend more on maintaining outdated infrastructure than investing in innovation or digital banking upgrades. This creates a costly cycle where there’s little room for adopting newer technologies or offering competitive financial products.

Falling Behind in the Fintech Era: Modern fintech companies use agile, cloud-native systems to launch products quickly, enhance user experience, and drive growth. In contrast, co-operative banks using legacy platforms find it increasingly difficult to retain customers who are accustomed to fast, flexible, and mobile-first banking experiences.

Modern core banking software solutions represent a fundamental shift in how financial institutions operate. Built for scalability, flexibility, and integration, they enable co-operative banks to thrive in a digitally connected economy.

- Seamless Integration with APIs: With robust API-driven architecture, modern core banking systems support open banking initiatives. This allows co-operative banks to integrate with third-party fintech apps such as budgeting tools, loan calculators, and investment platforms—offering customers a unified financial ecosystem.

- Modular Flexibility and Faster Deployments: Unlike monolithic legacy systems, modern platforms are modular. Co-operative banks can easily deploy new features or services without disrupting existing operations. This modularity shortens the time-to-market for launching new banking products and ensures operational agility.

- Enhanced Security and Regulatory Compliance: Modern core banking platforms are built with advanced cybersecurity frameworks and designed for regulatory compliance. They support regular, non-disruptive updates that ensure your bank remains secure and aligned with industry regulations.

Strategic and Operational Benefits

Automation and Operational Efficiency

Modern systems automate key banking processes such as loan approvals, compliance reporting, and account reconciliation. This reduces manual work, minimizes errors, and brings significant cost savings.

Innovation and Customer-Centric Services

The most transformative advantage is the acceleration of innovation. Modern core banking solutions empower co-operative banks to launch new digital products, offer personalized banking, and respond to changing market conditions faster—keeping pace with agile fintechs and exceeding customer expectations.

How Hutech Solutions Can Help

At Hutech Solutions, we specialize in helping co-operative banks modernize their core infrastructure with cutting-edge core banking software. Our solutions are:

- Scalable: Built to grow with your bank

- Secure: Compliant with global standards and best practices

- Customizable: Tailored for your unique banking needs

- API-Ready: Designed to integrate with fintech tools and services

With Hutech Solutions, your co-operative bank can:

- Eliminate legacy bottlenecks

- Deliver next-gen customer experiences

- Reduce operational costs

- Launch new services faster

- Stay competitive in the digital banking era

Conclusion

The shift from legacy systems to modern core banking platforms is no longer optional—it’s essential for survival and growth. Co-operative banks that continue using outdated infrastructure risk losing relevance in today’s fast-paced, digital-first world. By embracing core banking modernization with trusted partners like Hutech Solutions, banks can achieve resilience, innovation, and long-term success. Now is the time to invest in future-proof banking systems that deliver the speed, personalization, and flexibility your customers demand.

MAIL US AT

sales@hutechsolutions.com

CONTACT NUMBER

+91 90351 80487

CHAT VIA WHATSAPP

+91 90351 80487

Humantech Solutions India Pvt. Ltd 163, 1st Floor, 9th Main Rd, Sector 6, HSR Layout, Bengaluru, Karnataka 560102