BFSI GCCs Enter a New Era

Global Capability Centers (GCCs) in the Banking, Financial Services, and Insurance (BFSI) sector are no longer just back-office support units. In 2025 and beyond, they are becoming strategic innovation hubs, driving cost efficiency, enabling scale, and unlocking digital transformation with cloud, AI, and DevOps.

For GCC leaders and BFSI executives, the question is no longer Should we build? but How do we transform and scale effectively?

India’s GCC ecosystem has grown exponentially:

- Over 1,950 GCCs are operational in India, employing more than 1.9 million professionals.

- GCCs contribute significantly to India’s GDP, with expected revenues exceeding $120 billion by 2030.

- GCCs drive innovation in key sectors: IT, BFSI (Banking, Financial Services, Insurance), healthcare, and manufacturing.

Hutech enables GCCs to maximise operational efficiency and scale effectively using AI-enabled platforms, predictive analytics, and cloud-native architectures, directly supporting business growth and sustainability.

Why GCCs Are Critical for BFSI Transformation

- Cost Efficiency at Scale

Optimizing IT spend while ensuring compliance and security.

Leveraging cloud-native platforms to reduce infra costs. - Reliability & Resilience

Site Reliability Engineering (SRE) ensures 99.9% uptime for high-volume transactions. DevOps maturity accelerates deployment while mitigating risks. - Talent & Expertise

Access to skilled talent pools in AI, Salesforce, Finacle, and cloud-native development.

Continuous upskilling ensures future-ready teams. - Innovation at Speed

AI-driven fraud detection, real-time risk monitoring, and customer personalization.

Data-driven insights to predict market trends and customer behavior.

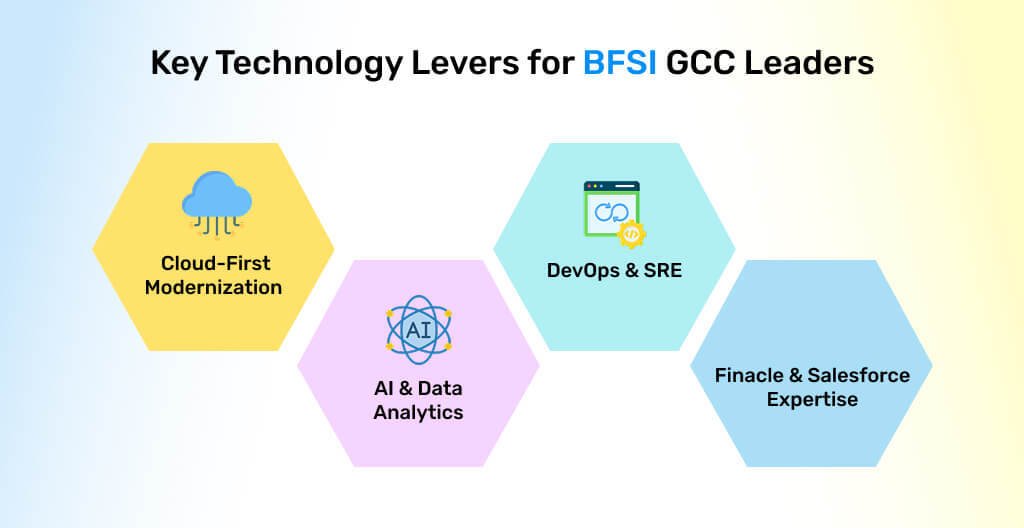

Key Technology Levers for BFSI GCC Leaders

- Cloud-First Modernization – Move from legacy systems to scalable, secure cloud platforms.

- AI & Data Analytics – Transform compliance, fraud detection, and customer engagement.

- DevOps & SRE – Automate, accelerate, and ensure system reliability at scale.

- Finacle & Salesforce Expertise – Core BFSI platforms modernized for agility.

Proof of Execution: From Vision to Reality

At Hutech Solutions, we’ve partnered with leading BFSI GCCs to deliver:

- 30% cost savings through cloud migration and automation.

- Faster product rollouts with DevOps and CI/CD pipelines.

SRE maturity frameworks that ensure business continuity and resilience.

The Road Ahead: GCCs as Growth Engines

As BFSI faces increasing regulatory, customer, and technological demands, GCCs will continue to evolve into growth engines, balancing cost, talent, and innovation.

Organizations that embrace this transformation will not only gain efficiency but also unlock innovation capacity to lead in the digital-first BFSI landscape.

Conclusion

The next wave of BFSI GCCs is about scale, speed, and sustainability. With the right blend of cloud, AI, and DevOps, GCCs can become the true innovation backbone of global banking and financial services.

MAIL US AT

sales@hutechsolutions.com

CONTACT NUMBER

+91 90351 80487

CHAT VIA WHATSAPP

+91 90351 80487

Humantech Solutions India Pvt. Ltd 163, 1st Floor, 9th Main Rd, Sector 6, HSR Layout, Bengaluru, Karnataka 560102