Fintech apps have transformed the finance sector by making services more accessible, efficient, and user-centric. They streamline transactions and offer personalized financial advice, driving innovation in the industry. This article explores their impact and the creative solutions they enable.

The Evolution of Fintech

Fintech has rapidly evolved since the late 20th century with the rise of the internet. Early advancements in the 1990s included online banking and electronic payments, leading to innovations like mobile banking apps and digital wallets. Today, top fintech app development companies in India are at the forefront of this evolution, driving innovation and delivering cutting-edge solutions that continue to transform the financial landscape.

The second wave of fintech, spurred by the 2008 financial crisis, introduced a surge of businesses focused on democratizing financial services. Rapid growth in the 21st century has been driven by advances in blockchain, AI, and machine learning, resulting in a diverse fintech ecosystem including biometric security, cryptocurrency exchanges, and robo-advisors. Fintech continues to expand and transform the banking sector, with the market projected by FinancesOnline to grow at a CAGR of 23.58% from 2021 to 2025.

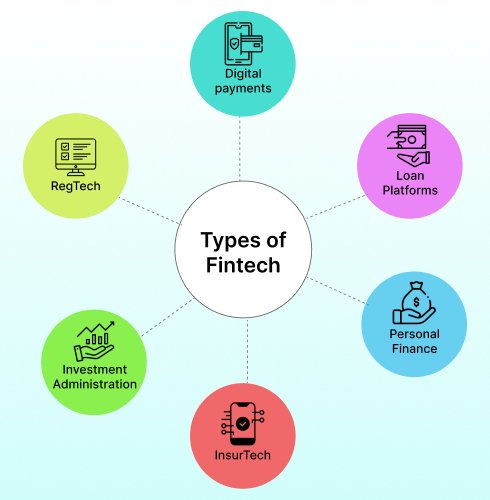

Types of Fintech

Fintech is divided into sectors, each of which focuses on a particular area of the financial business. Some key types are:

1. Digital payments.

Digital payment systems improve transaction speed, security, and convenience.

- Mobile wallets: Digital wallets like Apple Pay, PayPal, and Google Wallet revolutionize financial management by enabling secure, quick transactions on smartphones and computers, making services more convenient and accessible.

- Peer-to-Peer (P2P) Payment Systems: Platforms like Venmo and Zelle allow quick, low-cost money transfers between individuals and simplify tasks like splitting expenses and sending gifts.

- Contactless Payments: Enabled by technologies like NFC and QR codes, let customers pay by tapping their phones or scanning a code, enhancing the shopping experience.

2. Loan Platforms

Lending platforms are fintech technologies that help underfunded startups, small enterprises, and other ventures find investors and raise funds to get started.

- Peer-to-peer (P2P) lending: Companies such as Lending Club and Prosper connect borrowers directly with investors, avoiding traditional banks and providing more competitive interest rates and terms.

- Online Lending: Platforms like SoFi and OnDeck provide fast, streamlined loan access with quicker approvals than traditional banks. With our best fintech app development services, you can create similarly seamless and user-friendly platforms that excel in the competitive fintech market.

- Microloans: Services such as Kiva provide small, short-term loans to individuals or small enterprises in poor nations, thereby encouraging financial inclusion and economic growth.

3. Personal Finance

Personal finance applications have given users control over their budgets and savings by providing personalized tools and insights for improved money management.

- Budgeting Tools: Apps such as Mint and YNAB (You Need a Budget) enable users to track their income and expenses, create budgets, and analyze their financial health in real time.

- Savings Automation: Services such as Digit and Qapital automatically analyze spending habits and send tiny amounts of money into savings accounts, allowing users to save without conscious effort.

- Credit Monitoring: Apps like Credit Karma offer free access to credit scores and reports, as well as personalized advice for improving your credit.

4. InsurTech

Insurance technology, or insurtech, uses technology to create more efficient and customer-focused insurance products.

- Digital insurance providers: Lemonade and Oscar, for example, offer customized insurance plans, expedite the processing of claims, and deliver a flawless client experience through the use of AI and data analytics.

- Usage-Based Insurance: Companies such as Root Insurance provide auto insurance by tracking driving behavior through smartphone apps, which may result in lower premiums for responsible drivers.

- Health and Life Insurance: Users can compare and buy health and life insurance policies online with the assistance of services like Policygenius, which streamlines the otherwise difficult procedure.

5. Investment Administration

Fintech has democratized investing by providing low-cost, user-friendly platforms and tools that make it available to a wider audience.

- Robo-Advisors: Companies such as Betterment and Wealthfront use algorithms based on their client’s financial goals to give automated investing advice and portfolio management, allowing individuals to invest with little effort.

- Micro-Investing: Apps such as Acorns enable users to invest small sums of money, generally by rounding up daily purchases to the nearest dollar and investing the change.

- Fractional Shares: Platforms like Robinhood and M1 Finance allow users to acquire fractional shares of equities and exchange-traded finances (ETFs), allowing them to diversify their portfolios despite having limited finances.

6. RegTech

Regulatory technology, or regtech, enables financial firms to comply with regulatory obligations efficiently and flexibly.

- Compliance Monitoring: Companies like ComplyAdvantage use AI and machine learning to monitor transactions and detect suspicious activity, helping institutions meet AML and counter-terrorist financing requirements.

- Identity Verification: Platforms like Jumio and Onfido offer digital identity verification services, guaranteeing that clients are who they claim to be and lowering the risk of fraud.

- Reporting Solutions: Services such as AxiomSL provide automated reporting solutions that assist financial firms in generating accurate and timely regulatory reports.

Key Effects of Fintech on the Financial Industry

- Enhanced Financial Inclusion: Fintech apps have broadened access to banking, credit, and insurance, enabling underserved populations to manage finances via smartphones.

- Streamlined Payments and Transactions: Blockchain, digital wallets, and contactless payments have revolutionized transaction speed, security, and convenience in finance.

- Improved Customer Experience: AI and machine learning offer personalized financial insights, boost fraud detection, and enhance investment management, improving user satisfaction and control.

- Innovation with Advanced Technologies: Fintech advances biometric security and cloud computing, enhancing the security, scalability, and accessibility of financial services.

Fintech Solutions for a New Era

Hutech Solutions is committed to delivering cutting-edge fintech solutions that meet evolving client needs. Our innovative, secure products leverage AI, blockchain, and emerging technologies to create intelligent, efficient, and user-friendly financial services. We aim to make finance simpler, smarter, and more inclusive for everyone.

*This content is intended solely for educational and informational reasons.

Content authored by Kashvi Dikshit

Frequently Asked Questions

Before building a fintech app, focusing on regulatory compliance, security, and user-centric design is essential for trust and usability. At Hutech Solutions, we also prioritize scalable technology, advanced analytics, and seamless integration with third-party services to deliver reliable and innovative fintech solutions.

The development timeline for a fintech app typically ranges from 6 to 12 months for a basic version, while complex solutions may take 12 to 18 months. Agile development and thorough planning ensure timely delivery.

The cost to develop a fintech app varies based on factors such as complexity, features, and development team expertise. For a precise estimate tailored to your needs, contact our experts. We offer customized solutions designed to meet your budget while ensuring high-quality development and cost efficiency.

Building a modern fintech app requires blockchain for security, AI and machine learning for personalization and fraud detection, and cloud computing for scalability. These technologies are key to creating innovative and resilient fintech solutions.

Ready to Advance your Digital Transformation?Get in touch with us.

Discover why Hutech is the right partner for your business.

MAIL US AT

sales@hutechsolutions.com

CONTACT NUMBER

+91 90351 80487

CHAT VIA WHATSAPP

+91 90351 80487

Humantech Solutions India Pvt. Ltd 163, 1st Floor, 9th Main Rd, Sector 6, HSR Layout, Bengaluru, Karnataka 560102