The financial industry is undergoing a fundamental reconstruction, driven by artificial intelligence (AI). From self acting tasks to enhancing evaluation risk and fraud observation, AI in financial services is optimizing organization and reshaping conclusion-making processes. With the increasing promotion of AI banking tools and quick financial solutions, businesses and professionals must understand how this technology is revisiting the industry. This blog searches the role of AI in finance, its key applications, interests, challenges, and coming time trends.

Table of Content

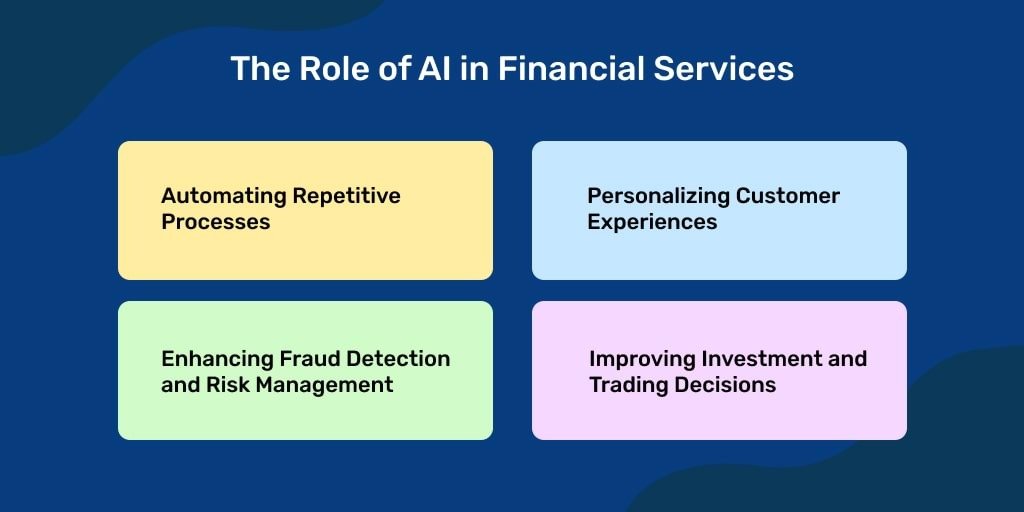

The Role of AI in Financial Services

AI has become an integral piece of the financial sector, providing data-driven understanding, simplified operations, and enhancing customer experiences. By influencing AI-powered algorithms and machine training models, financial institutions can make more enlightened decisions, minimize risks, and improve service delivery. Few of the key roles AI plays in finance include:

Automating Repetitive Processes

- AI automates data entry, detail generation, and regulatory assent processes.

- Reduces operational costs and enhances productivity.

Enhancing Fraud Detection and Risk Management

- AI-powered fraud detection systems examine transaction patterns to identify departure in real time.

- Machine learning copy assess credit risk and forecast potential financial fraud.g

Personalizing Customer Experiences

- AI chatbots and virtual assistants provide quick customer support.

- AI-driven insights offer tailored investment counsel and investment strategies.

Improving Investment and Trading Decisions

- AI description analyze market trends, helping traders make data-backed decisions.

- Robo-advisors provide customized investment advice based on user interests.

Key AI Applications in Financial Services

Financial foundation are adopting AI banking tools and financial mechanization solutions to optimize their services. The following are some of the most impressive AI applications in the finance industry:

AI-Powered Chatbots and Virtual Assistants

- Banks and financial firms use AI chatbots to assist customers with account inquiries and financial planning.

- Virtual assistants provide 24/7 customer service, reducing the burden on human agents.

Algorithmic Trading

- AI-driven trading systems execute high-frequency trades based on real-time market data.

- Machine impactful models identify profit making trading patterns and automate transactions.

Credit Scoring and Loan Processing

- AI assesses a borrower’s dependable based on alternative data sources.

- Streamlines loan approval processes and reduces bias in loan decisions.

Fraud Prevention and Cybersecurity

- AI models analyze user behavior to detect unusual financial activities.

- Financial institutions use AI-driven security measures to prevent cyber threats.

Regulatory Compliance and Risk Assessment

- AI ensures obedience with financial regulations by automating audits and reporting.

- Helps center identify and lessen potential financial risks.

The Benefits of AI in Financial Services

1. Increased Efficiency

- AI automates routine tasks, allowing expert to focus on strategic financial planning.

- Reduces refining times for agreement and customer queries.

- AI-driven insights help financial analysts make data-backed investment and impart decisions.

- Foreboding analytics assist in market forecasting and risk assessment.

- AI systems monitor financial affairs for signs of fraud in real time.

- Curbing financial losses due to false activities and cyber threats.

- AI-powered chatbots provide personalized and prompt financial support.

- AI-driven suggestions help clients manage their finances more effectively.

Challenges of Implementing AI in Finance

Data Privacy and Security Concerns

- AI relies on vast sum of customer data, raising concerns about data protection and assent.

- Financial institutions must implement vigorous security measures to protect sensitive information.

- AI-driven financial conclusions must comply with strict regulatory frameworks.

- Bias in AI canon can impact lending and investment decisions.

- Many financial institutions operate on legacy structure , making AI fusing complex.

- Updating systems to support AI applications requires important investment.

- AI adoption requires professionals to upskill and adapt to AI-powered tools.

- Financial institutions must provide training to employees on AI implementation.

The Future of AI in Financial Services

AI-Driven Predictive Analytics

- AI will provide even more accurate market forecasts, helping investors make neat decisions.

- Predictive analytics will be widely used for credit scoring and risk assessment.

- AI-powered blockchain solutions will add to transaction security and fraud prevention.

- Smart contracts will self-operate financial accord and reduce processing times.

- Robo-advisors will become more modern, offering a hyper-distinctive investment master plan.

- AI-driven financial planning will feed to discrete financial goals and risk outlines.

- AI-driven compliance tools will smooth regulatory reporting and fraud tracking.

- Automated auditing operations will secure portrait and accuracy in financial business.

Hutech Solutions: AI-Driven Financial Innovations

Hutech Solutions is at the spearhead of integrating AI into monetary services, offering advanced solutions tailored for occupations and professionals. With proficiency in financial automation, AI-powered risk management, and brilliant banking, Hutech Solutions helps financial institutions improve their operations and add to decision-making. By leveraging advanced AI technologies, Hutech Solutions contributes to driving innovation and ensuring that businesses stand competitive in the evolving economic landscape.

Conclusion

AI is the changing financial industry, presuming investment businesses with intelligent solutions that boost efficiency, security, and client experiences. From swindling prevention to AI-powered investment strategies, the applications of AI in financial services are vast and transformative. While challenges such as data security and regulatory compliance must be addressed, the benefits of AI-driven financial automation far outweigh the obstacles. As AI continues to evolve, financial institutions that embrace this technology will arrive for the driving edge, changing driving and adjusting the future of finance.

Ready to Advance your Digital Transformation?Get in touch with us.

Discover why Hutech is the right partner for your business.

MAIL US AT

sales@hutechsolutions.com

CONTACT NUMBER

+91 90351 80487

CHAT VIA WHATSAPP

+91 90351 80487

Humantech Solutions India Pvt. Ltd 163, 1st Floor, 9th Main Rd, Sector 6, HSR Layout, Bengaluru, Karnataka 560102